Methodology

Following a proprietary methodology of data-backed analysis, the ETR Observatory, unlike other industry reports, is designed to assess IT decision-maker (ITDM) usage of a vendor’s product and services within a specific subsector, and not the efficacy of the tools themselves. Our reports position subsector competitors relative to their peers based solely on ETR’s underlying data tracking spending, utilization, and depth or entrenchment within our ITDM group, the ETR Community. Vendors are plotted on the infographic solely according to real data drawn from the ETR Community.

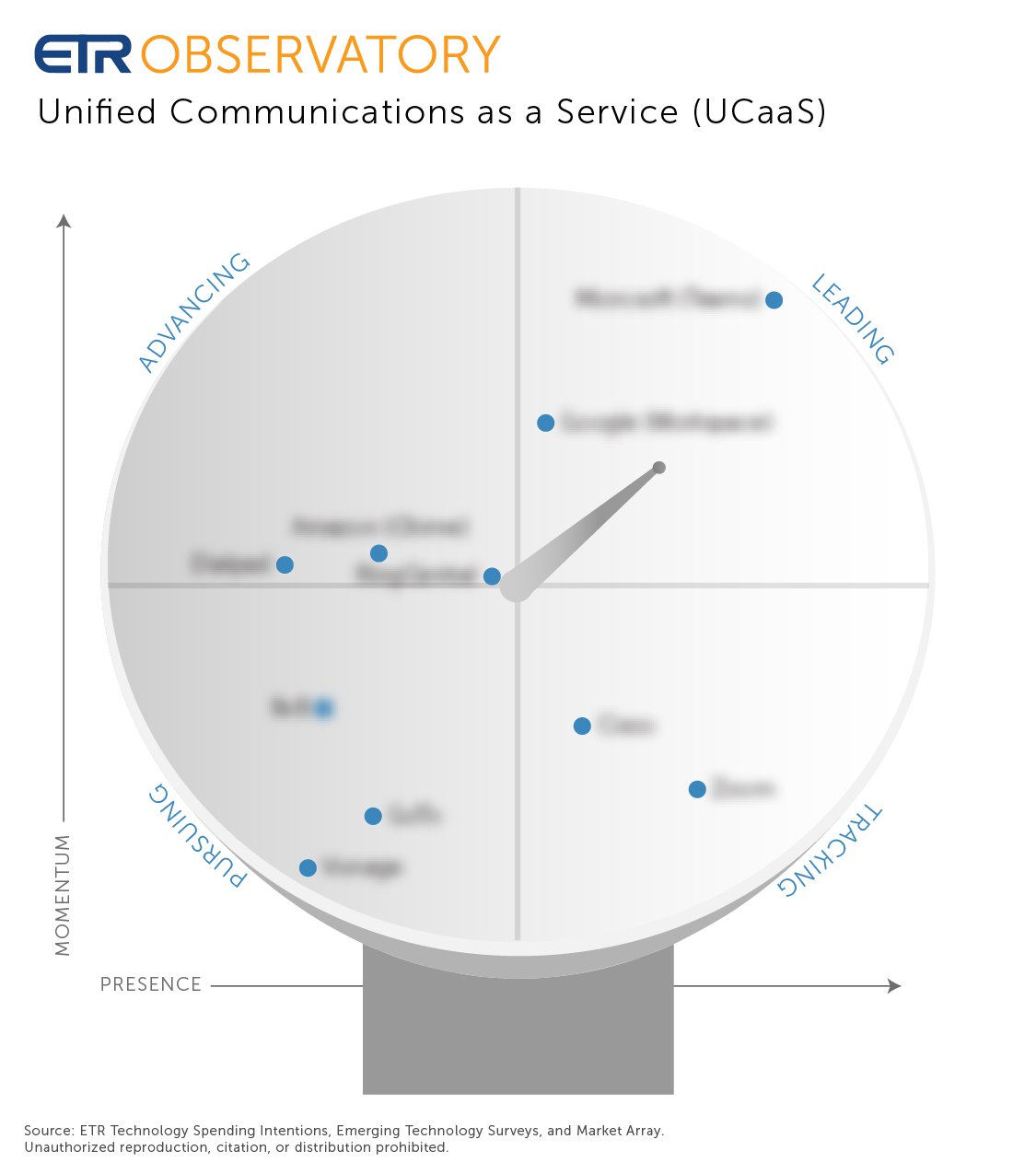

Backed by industry-leading survey data from a robust ITDM community, our ETR Observatory positions enterprise technology vendors in relation to their subsector peers. Vendors are positioned in Leading, Advancing, Tracking, or Trailing groups according to Momentum and Presence in the market. This is determined by leveraging data from ETR’s two core syndicated surveys, the Technology Spending Intentions Survey (TSIS) and Emerging Technology Survey (ETS), and ETR’s proprietary data set, the ETR Market Array. The plotting of the vendors in each subsector is based on the data, not opinions or vendor influence.

The more detailed accompanying Observatory reports examines the vendors within a subsector grouping by triangulating data from ETR’s TSIS, ETS, commentary from ETR Insights Interviews with ETR Community members, and proprietary industry analysis by our research staff.

The Observatory Infographic

The Observatory Infographic

The y-axis of the Observatory infographic represents the vendor’s overall Momentum within the subsector as based on ETR’s proprietary TSIS and ETS data, which tracks forward-looking spending intentions and utilization rates within our ETR Community. The x-axis represents the vendor’s overall Presence within the ITDM respondent population across both surveys.

The two axes are used to plot the subsector vendors within four groupings: Leading, Tracking, Trailing, and Advancing vendors. In the top-right grouping, Leading vendors are showing both strong Momentum and Presence. Inversely, the lower left grouping of Trailing vendors indicates both low Presence and Momentum relative to the other subsector peers. Advancing vendors (in the top left) are capturing strong Momentum within our enterprise ITDM population but do not yet have a high level of Presence. Lastly, the Tracking vendors are well established with widespread Presence but lower levels of Momentum. This category is often where mature vendors ultimately settle.

Observatory Methodology

Observatory Methodology

Momentum is a measure of a vendor’s spending and utilization, analogous but not identical to Net Score (TSIS) and Net Sentiment (ETS). Momentum is a weighted average of citations, where each citation is converted to a numeric score, reflective of whether that citation contributes positively or negatively to a vendor’s total market utilization.

Presence is a measure of a vendor’s penetration within its subsector in our survey work and is analogous but not identical to Pervasion (TSIS) and Mind Share (ETS) calculations. Presence is calculated as the number of citations for a given vendor, divided by the total number of survey respondents who indicate spending power in that vendor’s sector. This ratio is then passed through a logarithmic scaling function to emphasize differences between smaller vendors and deemphasize the difference between the largest and smallest vendors. As with Momentum, for vendors covered in both TSIS and ETS, we calculate the final Presence score as the average of the two scores derived from each survey.

Back to Summary | About ETR | Key Terms | Methodology